Notes on indirect rates

It can be confusing navigating accounting in academic research, and thankfully there are admin pros that do most of that work for us, but it’s good to know some basics. I share information like this with my lab, to help personnel learn about this side of science. Even though it’s boring. I’m posting these notes in case others find it useful.

Terminology. Like many types of jargon– sometimes different terms are used for the same thing, and other times the meaning of a term depends on who is using it. This post is going to stick to US terminology, and I’ll try to make it clear when terms are referring to the same thing.

Grants have two components: a “direct” component that is spent for lab equipment, supplies, salaries, etc., and an “indirect” a.k.a. “overhead” component that goes to the institution to provide things like lab space, electricity, administrative support, facilities management, health & safety personnel, and so forth.

When you see a new grant reported in a press release from a university, it is almost always pooling these two amounts together into “total costs” because that’s a bigger number. And it’s a relevant number– that is how much the funding institution (NIH, NSF, DOE, etc.) is paying for the work to be done.

Percentages. What fraction of the total is “indirect” aka “overhead”? Good question. If it’s a normal government grant, like NIH or NSF, you can look up the institutions “indirect rate” a.k.a. “F&A rate”. There are usually multiple rates, for different situations (e.g., on-campus research is a higher rate than off-campus research). Many institutions currently have indirect rates around 55%.

** That doesn’t mean that 55% of the grant goes to overhead. ** Common misconception when first learning about indirect rates. Instead, the indirect rate is the multiple applied to the direct costs to figure out what the indirects will be. For example, if a grant has $1,000,000 in direct costs, the indirect costs will be $550,000, and the total costs are $1,550,000. The indirect rate of 55% means that 35.5% of the total costs go to overhead.

But actually, that’s the upper limit of what would go to overhead. Many items in the direct budget are excluded from the indirect costs calculation, including tuition remission and equipment purchases. So for that same $1,000,000 grant, if it includes $100,000 of equipment purchases and $50,000 of tuition remission, then the indirect amount is calculated as 0.55*($1,000,000 – $150,000) = $467,500. So the total costs are $1,467,500 and 31.9% of that goes to overhead.

The overhead can change. One funny thing is that the indirects are re-calculated during the grant term, but the total costs DON’T CHANGE. So, for example, if you buy $100,000 worth of equipment that wasn’t on the original grant, you actually get some indirects back into your grant balance. That $100,000 in directs was accompanied by $55,000 of indirects when the grant was initially awarded because they thought you were going to spend it on consumables or some category that incurs overhead. Now that you are spending it on equipment, which can’t be charged overhead, that $55,000 has to go somewhere (and it doesn’t go back to the government). Similarly, if you don’t buy equipment you had planned on, and spend the money on salaries, you won’t have the full amount to spend. Some will be held back for overhead.

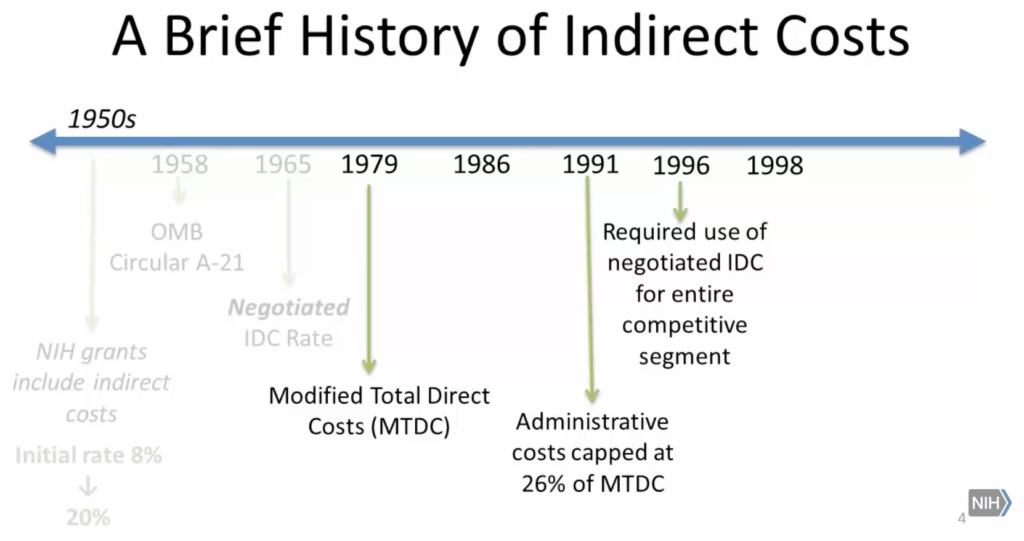

How are overhead rates set? No one knows.

Okay, actually, it’s a negotiated process, and there are multiple components. We posted about one weird factor a while ago. Most institutes, both public and private, are around 55% +/- 5% right now. That applies to MIT, Stanford, UCLA, Berkeley. There are a few in the 60s (e.g., Yale) and some that are even higher- over 90% (e.g., Max Planck Florida). Remember, this is the multiple applied to the direct costs, and it only sets an upper bound (because some budget categories are subtracted before applying the multiplier to determine the indirect costs). If the indirect rate is 100%, then that means that half of the total costs can go to overhead.

Not all funding agencies pay the same indirect rate. All US government agencies do, but private foundations can set their own rules. They might want a larger fraction of their money to go to the lab. In those cases, the home institution, where the lab is, will have to agree to a “cost-share”, which is what it sounds like. The institution is picking up the tab for whatever the funding agency isn’t. Many early career awards from private foundations have rules like this, as do some private foundations dedicated to specific diseases. Some institutions have blanket prohibitions on these cost-shared awards– you can’t even apply for them. Some other institutions will require you to pay for the cost-share from your start-up costs or other unrestricted funds. And I’m not talking about just small, cash-strapped institutions– big institutions with significant endowments do this too. Still, most major research universities in the US will be happy to do the cost-share. Or at least consider them on a case-by-case basis.